2020 earned income credit calculator

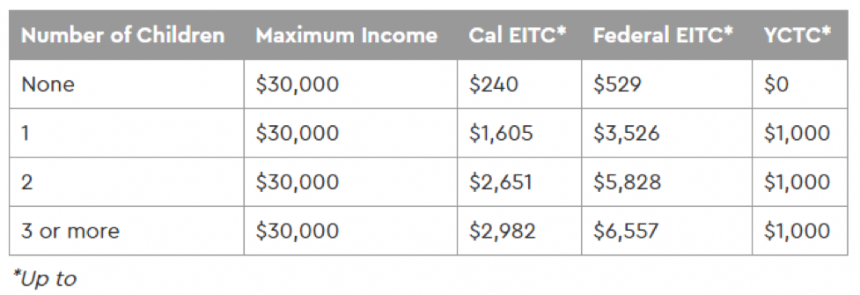

The maximum amount you can get from this credit is 6728 for the 2021 tax year which. The EITC is based on how many children you have and how much you make per year.

Pin On Deku X Froggy

Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own.

. Required Field How much did you earn from your California jobs or self-employment in 2021. The IRS questioned the EIC and you. Guaranteed maximum tax refund.

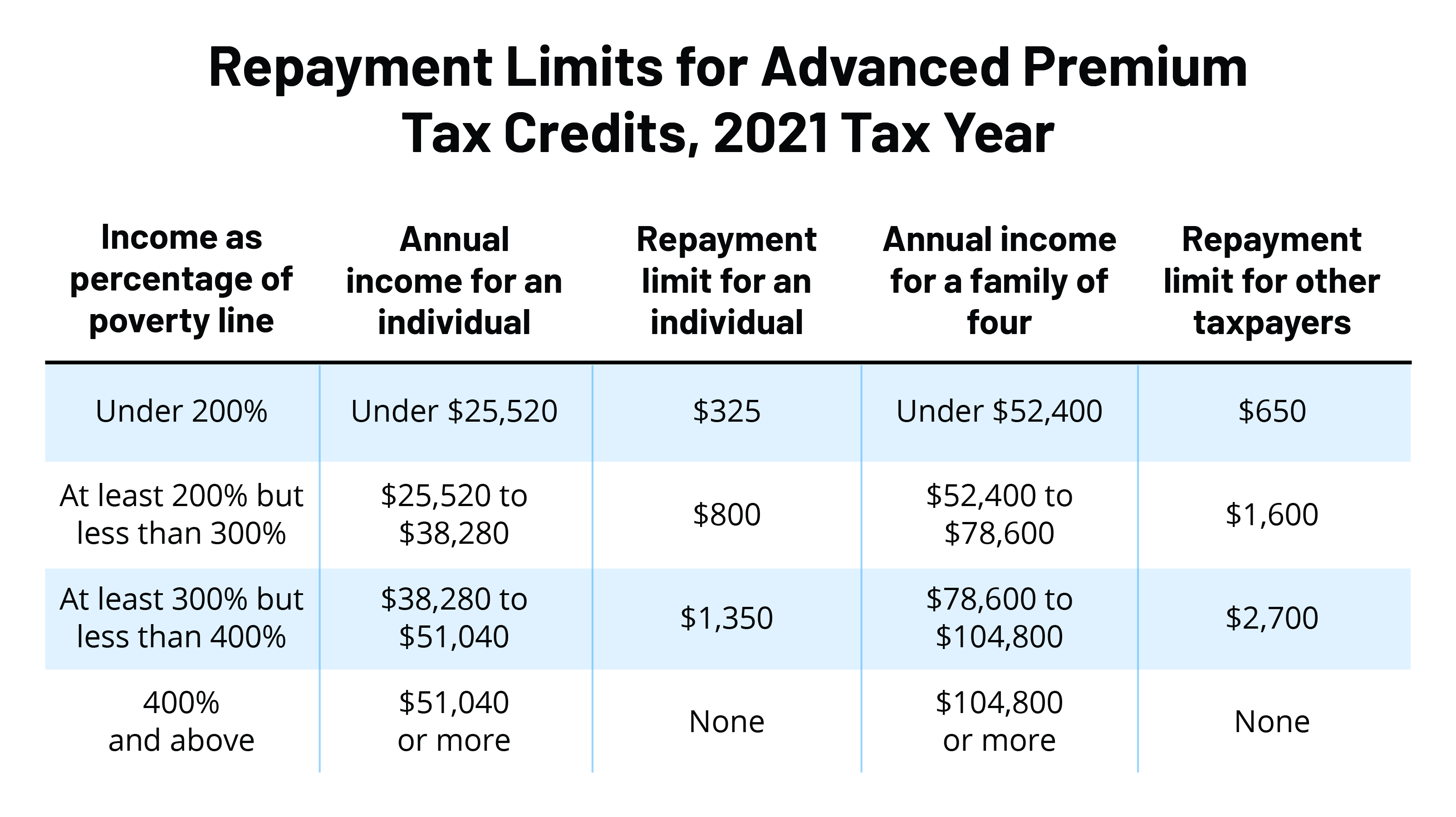

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Ad Free tax filing for simple and complex returns. Election to use prior-year.

Select your tax year. Friday September 18 2020. The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break.

Earned Income Credit EIC is a tax credit available to low income earners. Earned Income Tax Credit calculator instructions. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Use this EIC earned income credit calculator to see if you qualify for the credit and if so how much it might be worth to you and your family. 100 Money Back Guarantee. Generally if your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income.

Get Up To 26k Per Employee Even If You Received PPP Money. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that.

If you qualify you can use the credit to reduce the taxes you owe. If youre eligible for the. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes.

For wages and other income. To support economic relief from the COVID-19. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Discover Helpful Information And Resources On Taxes From AARP. You filed your 2020 tax return in March 2021 and claimed the EIC with a qualifying child. Ad Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit.

Use this calculator to find out. Enter the number of children in your family that qualify for the Earned Income Credit EIC. Whole dollars no commas.

If you are eligible for the Earned Income Tax Credit or made 57000 or less in 2020 have a disability or are a limited English-speaking taxpayer you can get your tax returns filed for free. Select your tax filing status. The Earned Income Tax Credit EITC or EIC is a refundable income tax credit for working individuals and families with modest incomes.

Answer some questions to see if you qualify. The EITC can be a significant tax creditIt can be worth as much as 6728 for the 2021 tax year and 6935 for the 2021 tax year. The EITC is based on how many children you have and how much you make per year.

The maximum amount you can get from this credit is 6660 for the tax year which is a. Andrew LePage Administrative Services. Earned income credit has no effect on certain welfare benefits.

The EIC reduces the amount of taxes owed and may also give a refund. As a refundable credit the EIC becomes a tax. Max refund is guaranteed and 100 accurate.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Select your qualifying children. However a lesser credit for those who dont have children and can be valued at about 538 for 2020 income tax returns.

Free means free and IRS e-file is included. However the credit amount varies significantly. The IRS has a set of three requirements that must be met to have a child considered qualified.

Earned Income Tax Credit Calculator and Volunteer Income Tax Assistance Locator.

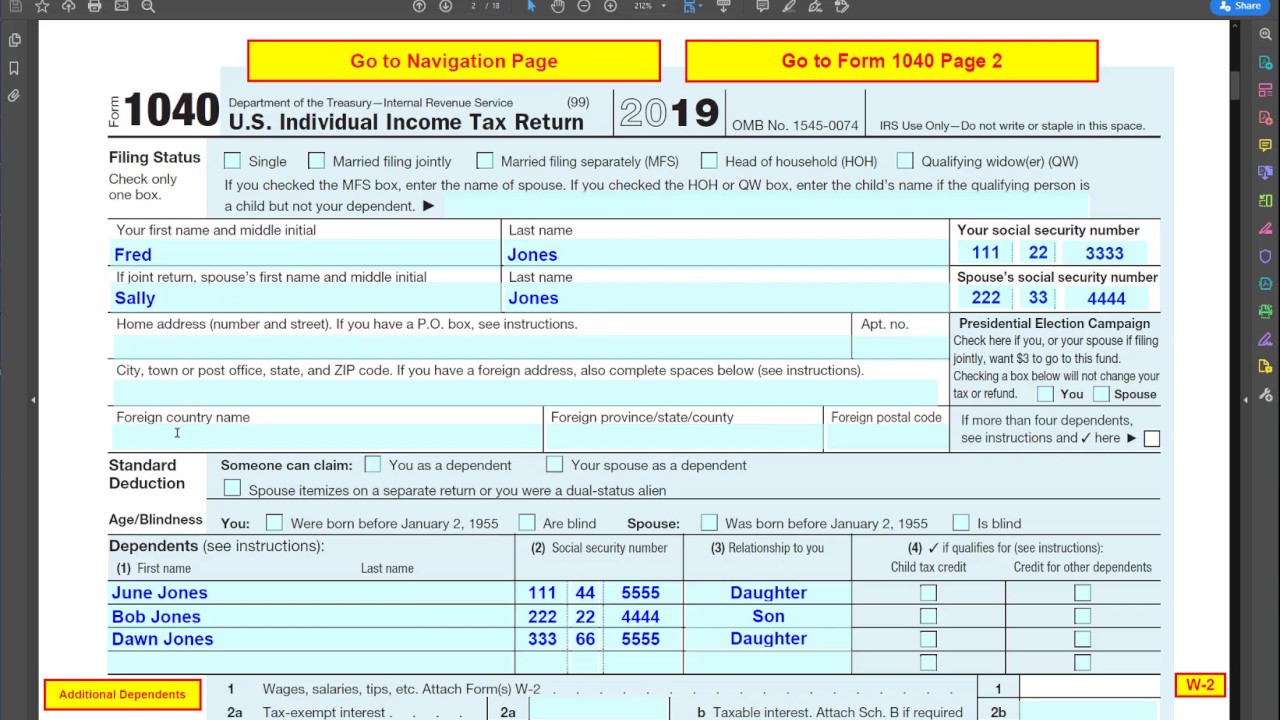

Form 1040 Earned Income Credit Child Tax Credit Youtube

Earned Income Credit Calculator H R Block

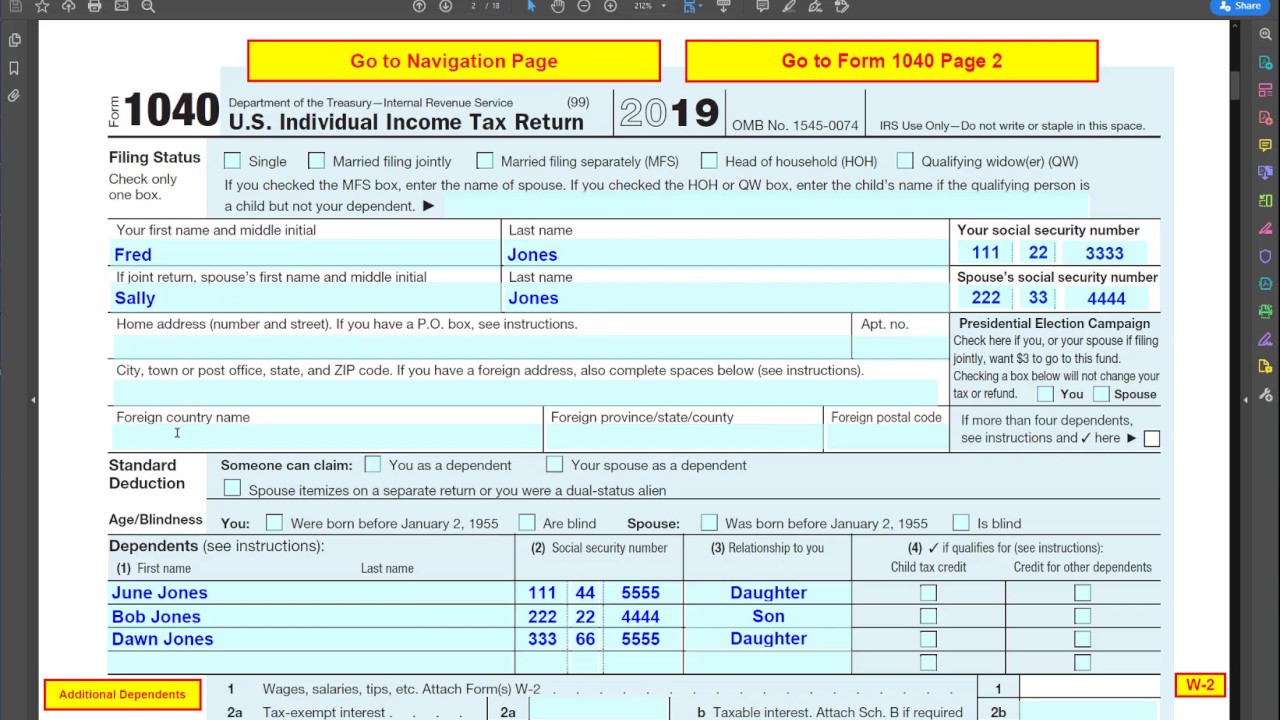

What S The Most I Would Have To Repay The Irs Kff

Earned Income Tax Credit For 2020 Check Your Eligibility

Earned Income Credit Eic

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

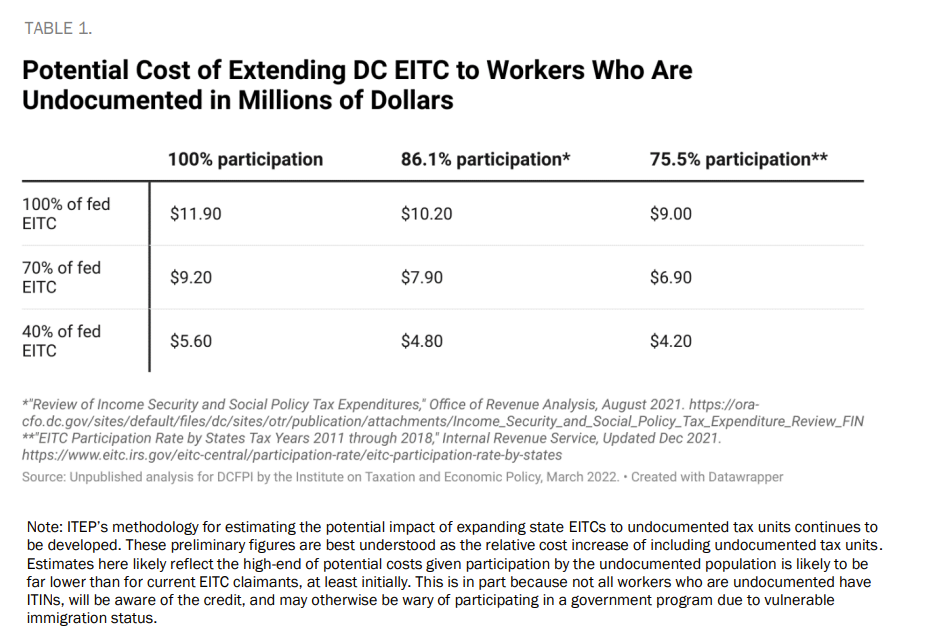

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Get Started On Your Mortgage Free Journey By Finding Out If Heloc Is Right For You Download Our Fr Mortgage Payment Calculator Line Of Credit Mortgage Payment

2019 Financial Planner Free Printable Financial Planning Printables Financial Planner Printables Budget Planner Free

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Freebie Friday Free Bill Tracker Bill Tracker Bill Tracker Printable Bill Organization

2

How To Make A Simple Budget Simple Budget Simple Budget Worksheet Budgeting Worksheets

Best Buy Credit Card Best Credit Cards Credit Card Pictures Credit Card

Personal Size Financial Planner A6 Financial Planner Filofax Etsy Budget Planner Printable Financial Planner Financial Planner Printables

10 Reasons To Abolish The Tipping System In Restaurants Tax Deductions Tax Attorney Tax Time

Earned Income Credit Eic